From February 2018 the default investment strategy for any SASS deferred member will change from the Growth Strategy to the Balanced Strategy once they turn 60.

Why is the change being introduced?

Any adverse fluctuation in market performance could have a negative effect on the final balance of members’ superannuation benefits. Switching the deferred benefits of members at age 60 may reduce the exposure of those members to any adverse market movements in the period leading up to their retirement.

Members will be notified by letter two months in advance of their 60th birthday that the deferred benefit will be switched to the Balanced Strategy unless they opt-out.

More about the investment strategies

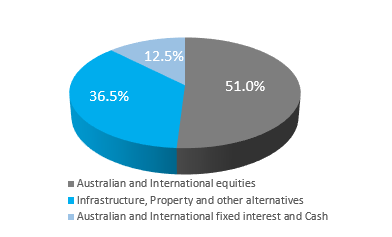

The Growth Strategy is intended for a longer-term investment horizon of seven years or more and for members with a higher tolerance for market volatility.

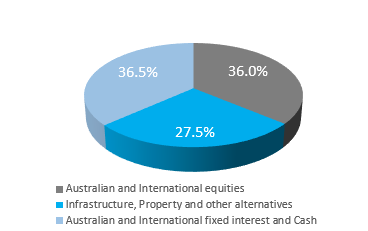

For comparison, the Balanced Strategy is designed for those with a medium-term investment horizon of five to seven years and who have some tolerance for market volatility. It aims to achieve returns that exceed inflation by more than 2.25% over a seven-year period. The risk profile of the Balanced Strategy is medium – with a negative annual return estimated to occur in 2 or 3 years over any 20-year period.

Growth - Strategic Asset Allocation

Balanced - Strategic Asset Allocation

The right investment strategy for you

Whether you’re a SASS active or SASS deferred member it’s important to understand there are components of your super where you have investment choice and these choices can significantly influence your investment outcomes.

Your fund offers a variety of investment strategies (Cash, Conservative, Balanced and Growth) giving you the ability to match an investment strategy to suit your time horizon and appetite for risk. And you have the flexibility to spread your super across more than one strategy and switch your mix to suit your changing circumstances.

For more information on how the different strategies compare, please refer to SASS Fact Sheet 15 Choosing an investment strategy.

Professional Advice

Aware Super provides our members and their families with access to comprehensive financial planning advice and education services.

The first appointment with an Aware Super financial planner is free of cost or obligation, and will give you a chance to consider creating a plan for you that is specific to your needs, goals and situation. There will be a fee for this personal financial plan, and the fee will be discussed with you before any work is commenced.

Your planner can discuss not only your financial situation, but also look at other considerations that affect you holistically. They can also advise on your partner’s financial situation, even if they are a member of another super fund.

You can contact Aware Super on 1800 620 305 or visit https://aware.com.au/state-super.

Note: Aware Financial Services Australia Limited (Aware Financial Services) (ABN 86 003 742 756) holds an Australian Financial Services Licence (AFSL number 238430) and is able to provide you with financial product advice. Aware Financial Services is owned by Aware Super Pty Ltd as trustee of Aware Super. State Super does not pay fees to, nor receives any commissions from Aware Financial Services for financial planning and member seminar services provided to State Super members. Neither State Super nor the New South Wales Government take any responsibility for the services offered by Aware Financial Services and its related entities, nor do they guarantee the performance of any service or product provided by Aware Financial Services and its related entities.