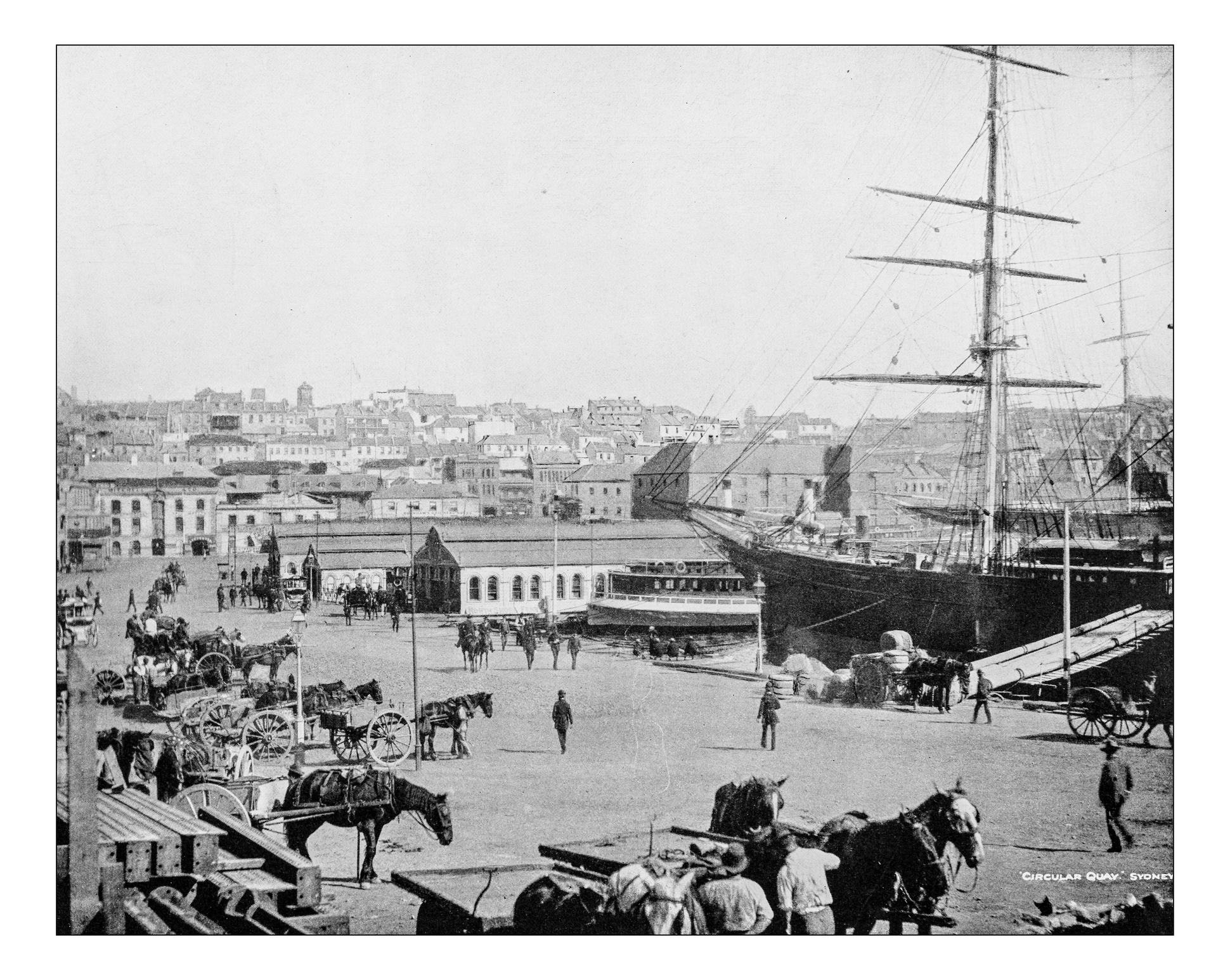

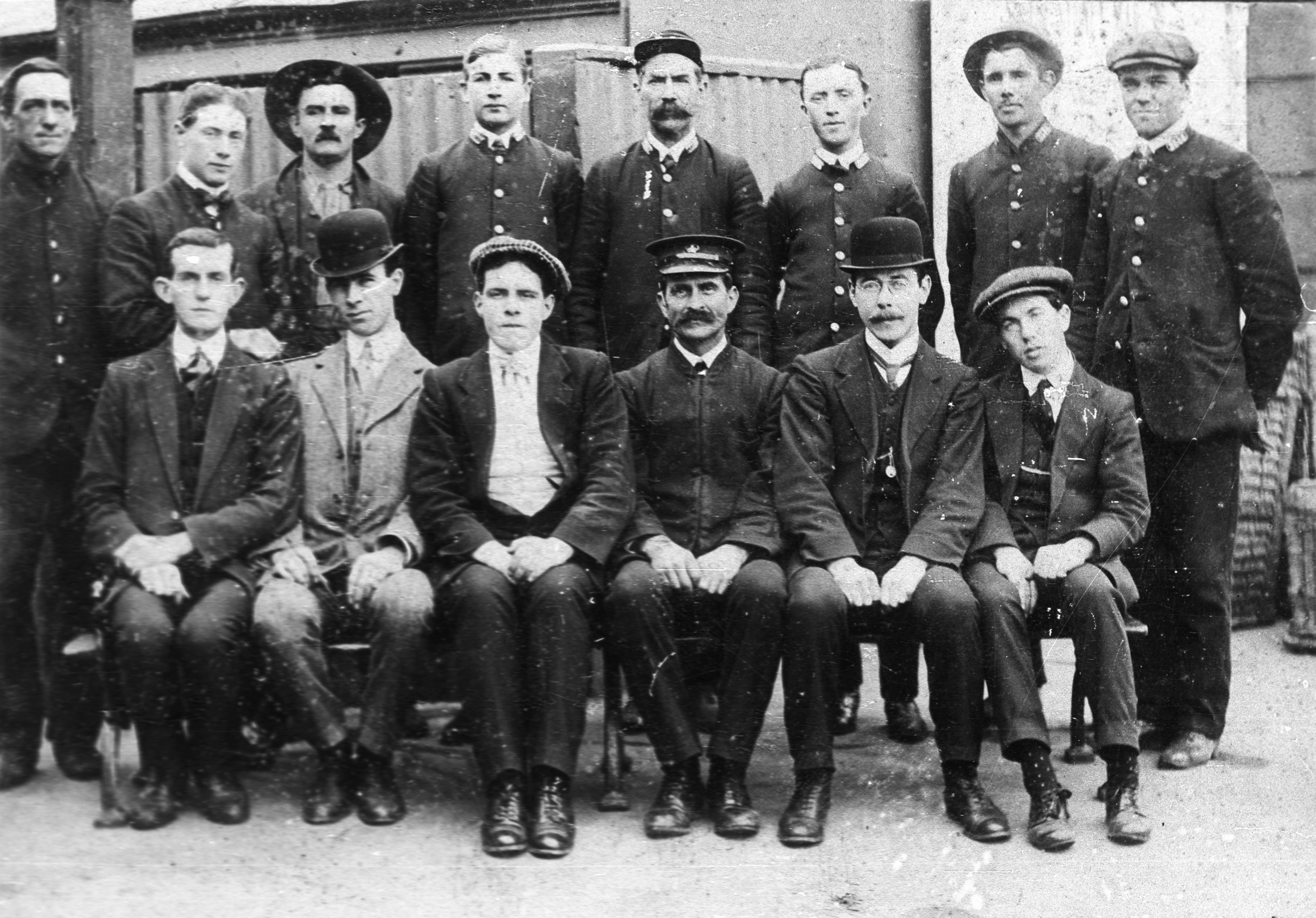

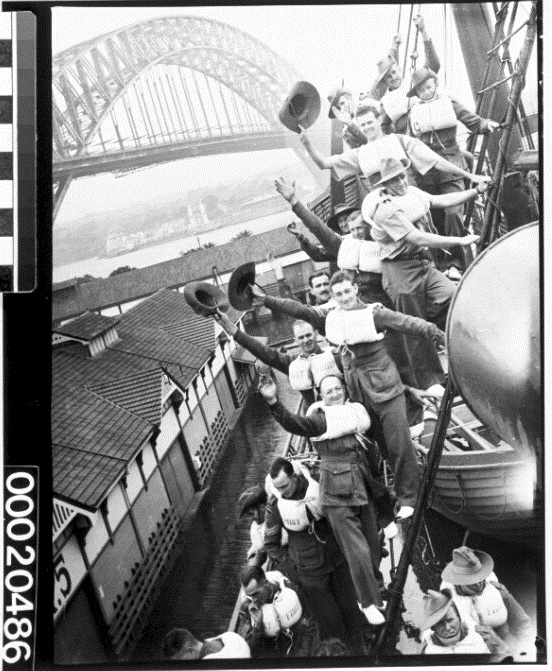

At State Super, we are proud of our history, and the foresight of the NSW government back in the early 20th Century to consider the retirement needs of its workers. Since 1919, superannuation for public service and public sector workers has continued to grow and change, and the State Super Schemes are an important part of our country’s history. You can find out more about this history by watching the video below, or scrolling through our interactive timeline.

What option best describes your membership?